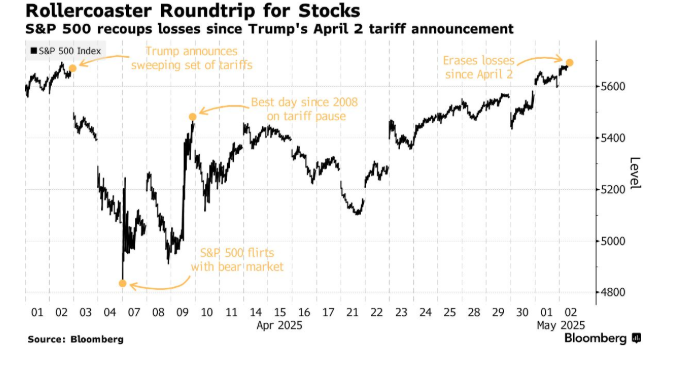

The S&P 500 just notched its longest winning streak in more than 20 years. After climbing for nine straight sessions and gaining 10%, it has now erased all the losses suffered since April 2 — the day President Donald Trump launched his global trade war.

But as the article puts it: “The question is why.”

The answer? “With so much of Wall Street’s institutional money staying on the sidelines, bullish individual investors are driving the gains.” And as the article highlights, “History says there’s little sense in fighting this enthusiasm.”

Quoting David Wagner, portfolio manager at Aptus Capital Advisors LLC:

“There are so many smart people in our industry that just don’t get the simplicity of how this market works over longer periods of time, and I think it actually creates an opportunity. Am I siding with the retail investors here right now? I might be.”

Cracks Beneath the Surface

Despite the bullish rally, the underlying fundamentals are shaky.

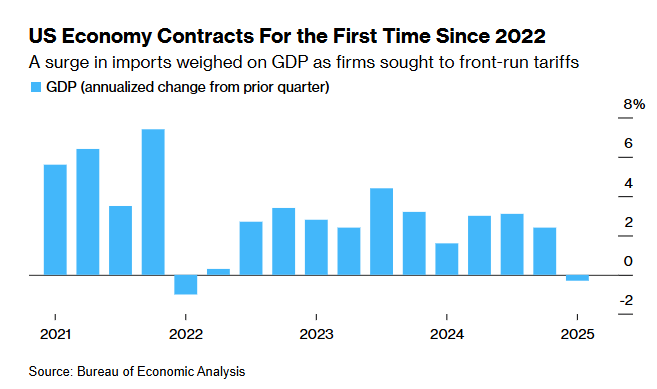

“Economic data has been uneven, as the impact of Trump’s sweeping tariffs is only starting to hit.” This week’s report from the US Bureau of Economic Analysis showed “that inflation-adjusted gross domestic product contracted in the first quarter for the first time since 2022.” Meanwhile, jobs growth in April was solid, but “the labor market is showing signs of cooling.” And consumer sentiment? “Also has been concerning.”

Earnings season didn’t deliver clarity either. “Earnings have been solid, but far from great.” Companies remain cautious. Microsoft and Meta posted strong numbers, but “Amazon.com Inc. and Apple Inc. indicated that trade pressures are starting to hit.” And while the administration “has talked about upcoming tariff agreements,” the truth is “nothing has happened and any concrete deals with terms nailed down are a ways off.”

Markets Dance While the Music Plays

Former Citigroup CEO Chuck Prince once said, “as long as the music is playing, you’ve got to get up and dance.” That sentiment echoes here.

Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Company, said:

“I think every day stays new and crazy until we start seeing if the soft data leaks into the hard data. Absent that, I think you continue to trade off of the back and forth of what’s happening on the trade negotiation front, which I think is going to be ever-present in the future.”

JPMorgan Chase’s trading desk said earlier this week that it had gone “tactically bullish on US equities.” Why? “Low positioning and light volume following the early April rout, as well as optimism that Trump will soon announce something involving progress in trade talks.” Still, the optimism has limits — the bank warned that “this momentum could fade quickly once tariffs begin to drag on the economy.”

Andrew Tyler, head of global market intelligence at JPMorgan, told clients:

“Overall, the de-escalation trade has room to run,”

but emphasized:

“This is not an all clear for markets.”

Retail Investors Take the Wheel

The article points to a major driver behind the surge: mom-and-pop investors.

“The latest rebound is largely being driven by the same retail trading cohort that has bought the dips in most of the recent bull markets.” In April, they snapped up $40 billion in US equities — “a record for monthly inflows,” according to JPMorgan’s Emma Wu.

At Bank of America Corp., “individual clients have been buyers for 19 consecutive weeks, the longest streak to start a year in the firm’s data going back to 2008.”

By contrast, institutional investors have only shifted slightly, moving from “significantly underweight US stocks to neutral,” according to Deutsche Bank AG. The bank adds: “It’s unlikely the

group will move to overweight stocks without concrete signs that Trump is backpedaling on his trade policies.”

Wall Street’s Growing Unease

For some money managers, the rally doesn’t make sense given the data.

“We were pulling back from markets starting late last year, so we have some dry powder,” said Keith Buchanan, senior portfolio manager at GLOBALT Investments LLC.

“But we’re scratching our heads right now at how the market can make a bottom before things are clear.”

That word — clarity — is what’s missing.

“Many companies, like American Airlines Group Inc. and Delta Air Lines Inc., have abandoned earnings outlooks for the year because the economic backdrop is just too uncertain.” Amazon, in particular, “gave a weaker-than-expected forecast for operating income and said it’s bracing for a tougher business climate in the coming months.”

As Bloomberg Intelligence’s Gina Martin Adams reports:

“Overall, the earnings guidance from Corporate America is the worst since the pandemic.”

Chris Zaccarelli, chief investment officer at Northlight Asset Management, summed it up:

“The opportunity for getting whipsawed is just so much higher because of the uncertainty. It’s an unintended side effect of really whatever the Trump administration is trying to do.”

Trade Talks: All Noise, No Resolution

On tariffs, uncertainty reigns.

“Chinese state media said the Trump administration has reached out to initiate talks,” but “it appears the US president’s tough stance has only strengthened China’s resolve to fight.” Meanwhile, “the Trump administration says it’s close to some kind of resolution with India, Japan and South Korea.” But, the article cautions: “Even if an agreement in principle is reached, it will likely take months or years to hammer out the final terms of a deal.”

Thomas Thornton, founder of Hedge Fund Telemetry LLC, warned:

“The markets have moved on comments from Trump and his administration, hopeful the tariff mess will just go away. Trade deals historically take a lot of time, and in a world when we can order something on Amazon and get it the next day, people have unrealistic expectations.”

Soft Data May Turn Hard

The final red flag: leading indicators suggest a slowdown is coming.

“US consumer sentiment is among the lowest going back to the 1970s,” and “long-term inflation expectations are the highest since 1981,” both driven by “fears of the tariff fallout,” according to the University of Michigan.

Kathryn Rooney Vera, chief market strategist at StoneX Group, delivered this stark warning:

“The soft data that has been envisioning a sharp economic downturn I think is going to quickly turn into hard data. Even if we get a trade agreement, I think volatility affects sentiment, consumption and investment.”

Homebuyers Back Off as Mortgage Applications Drop Amid Economic Jitters